Mirasol announces joint venture agreement for Gorbea Belt Gold-Silver Projects

VANCOUVER, BC, March 26, 2015 – Mirasol Resources Ltd. (“Mirasol” or the “Company”, TSX-V: MRZ, Frankfurt: M8R)

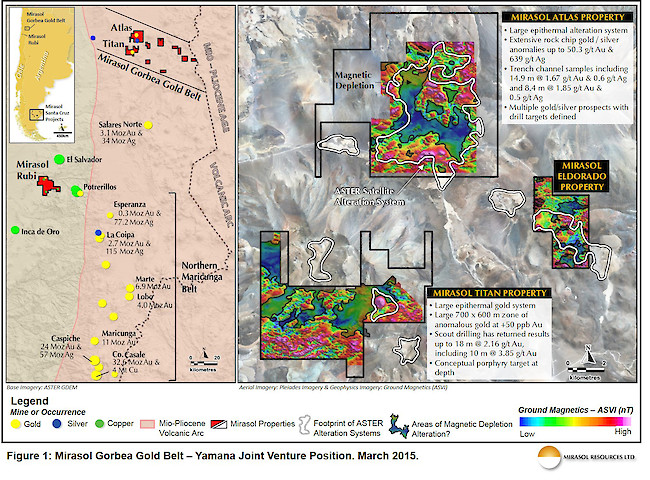

Mirasol is pleased to announce it has signed a joint venture agreement (the “Agreement”) with Yamana Gold Inc. (“Yamana”) granting Yamana the option to acquire up to a 75% interest in the Gorbea Belt Projects (“the Project”) (Figure 1). The option granted to Yamana will be exercisable in three stages over a seven year period.

- The joint venture agreement establishes Yamana as a strategic partner in the exploration and potential development of Mirasol’s Gorbea Belt Projects, including the Atlas and Titan projects

- The Agreement is subject to a 45 day due diligence review period, and grants Yamana the option to acquire up to a 75% interest in the Project over a seven year period.

- The first earn-in option to a 51% interest requires a spend commitment of US$10,000,000 and cash payments to Mirasol of US$2,000,000 over four years.

- The first year spend commitment is US$2,000,000, including geophysical surveys and 2,000 metres of exploration drilling at the Atlas and Titan projects.

Stephen Nano, the Chief Executive Officer of Mirasol, stated: “We are pleased that Mirasol have partnered with Yamana which has agreed to commit significant resources to the Gorbea Projects where recent exploration by Mirasol has identified several compelling drill targets at the Atlas and Titan projects. Yamana is an important gold producer with operating mines in Mirasol’s focus countries of Chile and Argentina. Yamana has also made a recent construction decision on its high grade gold – silver Cerro Moro project in Santa Cruz province Argentina, where Mirasol maintains a large portfolio of drill ready projects. Further exploration updates will be provided by Mirasol as exploration advances on the Gorbea Projects.”

William Wulftange, Senior Vice President, Exploration of Yamana stated: “This agreement underscores Yamana’s commitment to explore and expand our footprint in Chile, focusing on high quality opportunities that can lead to long term growth. Mirasol has an excellent track record of grassroots exploration and mineral discovery in South America, and I look forward to working with Stephen and his team on the Gorbea Belt Projects and similar opportunities that can fuel Yamana’s exploration project pipeline.”

The Agreement, which is subject to a 45 day due diligence review by Yamana, grants Yamana the option to acquire a 51% interest by incurring annual staged expenditures totaling US$10,000,000 and payments to Mirasol totaling US$2,000,000 over a four year period. The first earn-in option includes committed expenditures of US$2,000,000 by the first anniversary of which not less than US$1,200,000 must be spent at the Atlas project and US$600,000 at the Titan project. The first-year program includes an exploration commitment of electrical ground-based geophysical surveys and 2,000 metres of drilling at the Projects.

Yamana may exercise the second earn-in option to increase its interest to 65% within the subsequent two year period by completing an independent technical report in accordance with NI 43-101. A qualifying independent technical report will include a preliminary economic assessment based on an indicated mineral resource estimate of more than 1,000,000 ounces of gold, using a 0.3 gram per tonne of gold cut-off grade.

Yamana may exercise the third earn-in option to increase its interest to 75% by completing an independent feasibility level study, or equivalent, in accordance with NI 43-101 and making a “decision to mine” within an additional one-year period.

Subject to a decision to mine and a request by Mirasol, Yamana will provide financing to Mirasol for its 25% share of the development costs. Mine financing will be on commercial terms with interest calculated at LIBOR+3%. Mirasol’s share of the mine development costs will be repaid from 50% of Mirasol’s share of the cash flow from its interest in the mine.

The Agreement also provides Yamana the opportunity to extend the earn-in periods, subject to certain limitations, for up to three years by paying Mirasol US$500,000 per extension-year.

The Agreement provides Mirasol the right, exercisable at the 65% or 75% earn-in stages, to convert up to 9% of its equity position into a 3% net smelter return (“NSR”) royalty, and retain a participating equity position in the Project. Yamana retains a pre-emptive right to purchase from Mirasol a 0.5% NSR royalty, leaving Mirasol with 2.5% NSR royalty with the purchase price set by a third-party independent valuation process. In that event, Mirasol’s residual 2.5% NSR royalty is not subject to any further pre-emptive rights.

The Gorbea projects comprise nine 100%-owned claim blocks totaling approximately 20,700 ha located in the Miocene age mineral belt of northern Chile. The Gorbea projects include Mirasol’s Atlas and Titan high-sulfidation gold and silver projects (see news releases dated December 10th 2014, July 23rd 2014 and November 25th 2013) and seven other early-stage exploration prospects covering portions of prospective alteration systems.

For further information, contact:

Stephen C. Nano

President and CEO

Tel : (604) 602-9989 Fax : (604) 609-9946

Stephen Nano, President and CEO is the Qualified Person under NI 43-101 who has prepared and approves the technical content of this news release.

Email: contact@mirasolresources.com

Website: www.mirasolresources.com

Quality Assurance/Quality Control of exploration programs:

Exploration at the project was supervised by Stephen C. Nano, President and CEO, who is the Qualified Person under NI 43-101, Timothy Heenan, Exploration Manager, and Leandro Echavarria, Mirasol’s Principal Geologist. All technical information for the project was obtained and reported under a formal quality assurance and quality control (QA/QC) program. Rock channel and rock chip samples were collected under the supervision of Company geologists in accordance with standard industry practice. Samples were dispatched via commercial transport to an ISO 9001:2000-accredited laboratory in Chile for analysis. Results of this exploration program are routinely independently reviewed to confirm the Company’s QA/QC process/procedures and laboratory performance meet required standards.

Assay results from surface samples may be higher, lower or similar to results obtained from drilling due to surficial oxidation and enrichment processes or due to natural geological grade variations in the primary mineralization.

Forward Looking Statements: The above contains forward looking statements that are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in our forward looking statements. Factors that could cause such differences include: changes in world commodity markets, equity markets, costs and supply of materials relevant to the mining industry, change in government and changes to regulations affecting the mining industry. Forward-looking statements in this release include statements regarding future exploration programs, operation plans, geological interpretations, mineral tenure issues and mineral recovery processes. Although we believe the expectations reflected in our forward looking statements are reasonable, results may vary, and we cannot guarantee future results, levels of activity, performance or achievements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.